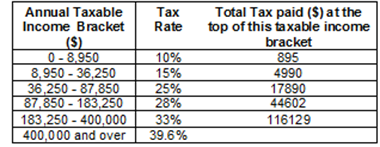

The table shows the total tax paid ($) on annual taxable income.

For example, a person with an annual taxable income of $60,000 will pay $4990 plus 25% of ($60,000 - $36,250)

Cory has an annual taxable income equivalent to $2,500 per month.She wants to save enough money each month to pay her tax for the year. The minimum amount, to the nearest $, that Cory has to save each month is: